Do You Need an Appraisal for a Cash Sale in San Francisco?

Author: Ms San Francisco Real Estate | Last Updated: November, 2025

San Francisco has a unique real estate market. In fact, it is famous for high prices. Additionally, transactions happen very fast here. Because of this, homeowners often have questions. Specifically, they wonder about appraisals.

Do you need an appraisal for a cash sale? Generally, the short answer is “no.” However, the full answer depends on your goals. Therefore, the decision is not always simple.

To help you, Ms. San Francisco Real Estate explains the process. Below is a simple guide on appraisals and cash sales.

🏠 What Is a Home Appraisal?

A home appraisal is a professional test. Basically, it evaluates your property’s value. Specifically, a licensed appraiser performs it. Then, they create a detailed report.

The appraiser looks at several key factors. For example, they check:

- Location: They look at your specific neighborhood. For instance, is the home in Noe Valley or the Sunset District?

- Size: The total square footage matters. Also, the layout is important.

- Condition: They examine the home’s state. Furthermore, they look for recent upgrades.

- Comps: They research nearby sales. Similarly, they compare your home to others.

- Market Trends: Finally, the overall market health affects the price.

Typically, buyers need appraisals for mortgages. In other words, lenders require them. However, cash buyers are different.

💰 Is an Appraisal Required for a Cash Sale?

Technically, the answer is no. Since a cash sale does not involve a bank, rules change. Therefore, no lender requires an appraisal. Thus, you have more freedom.

However, you might still want one. In reality, an appraisal helps both buyers and sellers. Here is why it can be valuable:

1. Accurate Market Value

First, you need a baseline. Essentially, an appraisal shows the home’s true worth. Consequently, you understand the value before selling.

2. Justify Your Price

Secondly, data provides proof. For example, the report justifies your asking price. As a result, you can avoid low offers. Indeed, this is vital when dealing with aggressive investors.

3. Legal Reasons

Furthermore, some deals are complex. For instance, divorce settlements often require appraisals. Additionally, estate divisions (probate) need them for tax purposes.

4. Investment Checks

Finally, investors are careful. Usually, they order appraisals. Basically, they want to verify their potential profit.

📊 Alternatives to a Formal Appraisal

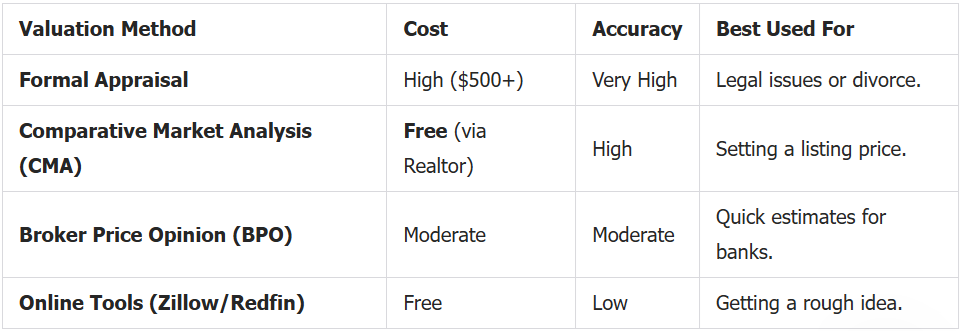

Unfortunately, appraisals take time. Also, they cost money. Fortunately, there are faster options.

Here is a comparison of your choices:

Why Choose a CMA?

Often, a Comparative Market Analysis (CMA) is best. Specifically, a local expert creates it. For instance, Ms. San Francisco Real Estate uses real-time data. Unlike online tools, a CMA looks at local details. Therefore, it is more reliable.

🤝 Work with a San Francisco Expert

Undoubtedly, selling for cash requires skill. Therefore, you need an expert. Whether you want a quick sale or a high price, we can help.

Ms. San Francisco Real Estate has over twenty years of experience. We provide:

- Market Insights: First, we use up-to-date data.

- Custom Strategies: Next, we help you sell efficiently.

- Cash Buyers: Moreover, we connect you with verified investors.

- Expert Advice: Finally, we guide you on pricing and closing.

Final Thoughts

In summary, cash sales do not mandate appraisals. However, knowing your value is key. Otherwise, you might lose money.

Ms. San Francisco Real Estate protects your interests. So, contact us today. Ultimately, let us help you get the best result.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link