Using Appraisals for HELOC Loans in San Francisco CA

Author: Ms San Francisco Real Estate | Last Updated: December, 2025

Currently, homeowners in San Francisco have many options. Specifically, they want to access their home equity. Fortunately, Home Equity Lines of Credit (HELOCs) are a popular choice. Basically, a HELOC turns equity into flexible cash.

However, there is a catch. Before approving a loan, banks require a step. Specifically, you need a professional home appraisal. This process determines your market value. Consequently, it decides how much you can borrow.

Ms. San Francisco Real Estate is here to help. As a licensed agent, I guide clients through this process. Below is everything you need to know to get approved.

💰 What Is a HELOC and How Does It Work?

First, let’s define the loan. Essentially, a HELOC is a revolving credit line. In fact, it works like a giant credit card. Crucially, it is backed by your home.

To illustrate, let’s look at the math. Suppose your financial situation looks like this:

- Home Value: $1.5 million

- Mortgage Owed: $800,000

- Total Equity: $700,000

Typically, banks lend up to 80% or 85%. In this example, you could access roughly $560,000.

Ultimately, this flexibility is great. For instance, you can use funds for renovations. Also, you can pay for education or debt.

🏠 The Role of the Appraisal

Undoubtedly, the appraisal is the most critical step. Why? Because it sets the limit of your loan. Therefore, a low appraisal means less cash.

Generally, a certified San Francisco appraiser evaluates four things:

- Condition: First, they check the size and layout.

- Comps: Next, they look at recent sales nearby.

- Location: Also, they judge the neighborhood vibe.

- Upgrades: Finally, they inspect renovations.

Consequently, this report gives the lender an accurate number. In San Francisco, accuracy is vital due to high prices.

📈 San Francisco Home Value Trends (2025)

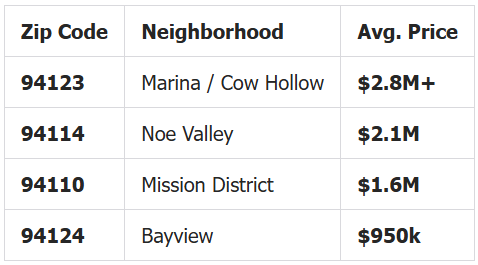

Importantly, location drives value here. In 2025, prices vary wildly by zip code. Therefore, your neighborhood matters.

Here is a quick breakdown:

As you can see, the gap is wide. Thus, a professional appraisal is the only way to be sure.

🚀 How to Maximize Your Appraisal Value

Naturally, you want the highest valuation possible. Fortunately, you can influence the result. Here are four steps to boost your value.

1. Enhance Curb Appeal

First, focus on the exterior. Specifically, tidy the yard and paint the trim. Because first impressions stick, this helps.

2. Perform Basic Maintenance

Next, fix the small things. For example, repair leaky faucets. Otherwise, the appraiser might suspect neglect.

3. Document Improvements

Also, prove your worth. If you renovated the kitchen, show the receipts. Similarly, list energy-efficient upgrades like solar panels.

4. Leverage Market Data

Finally, use your agent. Ms. San Francisco Real Estate can provide “comps.” Basically, these prove that similar homes sold for high prices.

Typically, the inspection takes 60 minutes. Afterward, you get a report. Usually, this costs between $600 and $1,200.

🤝 Why Work with Ms. San Francisco Real Estate?

Navigating this process can be stressful. However, expert help makes it easy. With over 20 years of experience, I know the system.

Specifically, I help you by:

- Connecting you with trusted appraisers.

- Preparing your home for the inspection.

- Strategizing on how to get the best loan terms.

Final Thoughts

In summary, the appraisal is the key to your HELOC. It determines your financial freedom. Therefore, do not leave it to chance.

Ms. San Francisco Real Estate is ready to assist. So, contact us today. Let’s unlock your home’s true potential together.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link