How Investors Use Appraisals to Flip Homes in San Francisco

Author: Ms San Francisco Real Estate | Last Updated: February, 2026

Currently, house flipping is a science. In San Francisco, the stakes are high. Therefore, guessing is dangerous. Instead, smart investors use data. Specifically, they use appraisal logic.

Basically, you must know the value before buying. Otherwise, you risk your cash. Fortunately, Ms. San Francisco Real Estate helps. We crunch the numbers. Below is your guide for 2026.

📐 1. The Magic Number: ARV

First, calculate the ARV. Simply, this is “After Repair Value.” Crucially, it predicts the future price.

Investors use ARV to decide:

- Price: Exactly what to pay today.

- Budget: How much to spend on repairs.

- Profit: What is left over.

To find this, we look at “comps.” Specifically, we find renovated homes nearby. Then, we compare them to your project. If you skip this, you fail. Thus, accuracy is key.

🧠 2. Think Like an Appraiser

Next, adopt the appraiser’s mindset. Before offering, analyze the deal. In fact, do the math yourself.

The Investor Checklist:

- Comps: First, find three closed sales.

- Condition: Next, compare the quality.

- Adjustments: Then, subtract for differences.

- Timing: Finally, check market trends.

Consequently, you find the “Max Allowable Offer.” Effectively, this prevents overpaying. So, you buy with a margin.

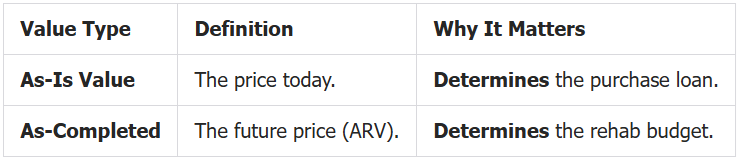

🏗️ 3. As-Is vs. As-Completed

Importantly, lenders see two numbers. Often, this confuses beginners.

Typically, hard money lenders need both. Therefore, your plan must be clear. If the spread is small, they say no. Thus, the math must work.

🛠️ 4. Bankable Renovations

Surprisingly, not all upgrades add value. Appraisers focus on function. Therefore, avoid personal tastes. Instead, focus on ROI.

What Appraisers Reward:

- Kitchens: Always update cabinets.

- Baths: Simply, make them modern.

- Systems: Crucially, fix the roof.

- Flooring: Ideally, keep it consistent.

Conversely, over-customization hurts value. So, keep it neutral.

📍 5. Neighborhood Strategy

Notably, San Francisco is patchy. In fact, values change by the block. Hence, your strategy must adapt.

- Condos: Here, HOA health matters.

- Houses: There, lot size matters.

- Location: Always, check the micro-market.

Proudly, Ms. San Francisco Real Estate prevents mistakes. Specifically, we stop “over-improving.” As a result, you save money.

🚪 6. The Exit Strategy

Eventually, you must sell. Usually, the buyer needs a loan. Consequently, the bank sends an appraiser. This is the final test.

If the appraisal is low:

- Option A: You lower the price.

- Option B: You offer credits.

- Option C: You challenge the report.

However, prevention is best. By pricing correctly, we avoid risks. Ultimately, the deal closes fast.

📈 7. Market Trends

Constantly, the market shifts. Appraisers watch the data. So, you should too.

Watch these metrics:

- Days on Market: If it rises, be careful.

- List-to-Sale Ratio: If it drops, lower offers.

- Inventory: If it spikes, competition grows.

Currently, we track this daily. Thus, you are never surprised.

❓ FAQs: Flipping & Appraisals

What is ARV? Simply, it is “After Repair Value.” It is your target.

Do I need an appraisal? Not always. However, your buyer usually does.

Which renovations pay off? Typically, kitchens and baths. Also, structural repairs.

Can a low appraisal kill a flip? Yes. If financing fails, the deal dies.

Final Thoughts

In summary, flipping requires precision. However, you can succeed. Ms. San Francisco Real Estate has the data. So, contact us today.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link